Helpful information

23 October 2021

Property insurance in Turkey. Tips for Nordic customers

Buying property in Turkey is prestigious and profitable - today many foreign citizens have already seen this. In addition to a simple and transparent scheme for concluding a sale and purchase transaction, the Republic of Turkey offers investors from abroad the opportunity to obtain reliable real estate insurance.

In our article, we will tell you about Turkish real estate insurance against natural disasters.

Why insure property in Turkey?

Turkey has voluntary and compulsory home insurance.

In the first case, you can take out an insurance policy in case of any risks: natural disasters, intentional and accidental damage, theft, fire, etc. Real estate insurance service in Turkey is provided by any private specialized organization.

Since the Republic of Turkey is located in a zone of high seismic activity and has already suffered several devastating earthquakes, the government of the country in the early 2000s decided to create the so-called State Earthquake Insurance Fund - Turkish Catastrophe Insurance Pool (TCIP), which included 32 companies.

The state insurance policy TCIP guarantees coverage of material damage to victims of fires, tsunamis, landslides, explosions caused by an earthquake. Along with this, large-scale work was carried out in the country to check, repair and demolish seismically unsafe buildings, and the requirements for developers regarding the technology and quality of construction were tightened in accordance with the seismic situation in different regions.

In accordance with the Law No. 587 of 12/27/1999 on Compulsory Earthquake Insurance, today Turkish natural disaster insurance DASK is mandatory when buying residential or commercial property. Without this document, it is simply impossible to complete a purchase and sale transaction.

Compulsory earthquake insurance DASK or Dogal Afet Sigortalari Kurumu will cover property damage and the cost of repairing a structure damaged by an earthquake. This system, despite the relatively small insurance premiums, allows you to cover the entire territory of the state and timely pay compensation to the victims. According to experts, DASK is one of the most successful natural disaster insurance systems in the world.

The DASK policy is issued after the acquisition of real estate in Turkey in any bank or insurance company. The document is renewed every year until the end of the current policy.

In the event of an insured event, monetary compensation is reimbursed after the assessment of damage and their documentary fixation within 30 days. The payment is issued in Turkish liras and amounts to a maximum of 550 TL per 1 sq.m., or a total amount of 240,000 TL, regardless of the type of property.

What does the insurance cover?

DASK state insurance provides compensation for damage caused directly by an earthquake and covers:

- building foundations;

- bearing and non-bearing partitions, floors;

- floor and ceiling;

- elevators, stairs, corridors;

- roof and chimneys;

- other additional parts of the building, where there are similar structures listed.

Insurance companies in Turkey do not indemnify losses under the DASK policy from earthquakes in a number of cases. For example, for the costs of removing construction debris or associated with moving to a new house, for moral damage, for damage to furniture, equipment, bodily injury or death, for the loss of money in any currency, if the building structure was faulty, etc.

What is the cost?

The cost of compulsory Turkish earthquake insurance depends on:

- Earthquake risk zones. The territory of Turkey is divided into several zones in accordance with the level of seismic activity.

- Characteristics of the building and structure. The main three categories of buildings are frame reinforced concrete and steel; brick or stone; other types.

- Year of construction and total area.

The estimated cost of DASK insurance in Turkey is about €15 - 150 per year. For example, in Alanya, the amount will not exceed €40 per year.

Be careful: the amount of the fee is reviewed and recalculated every year.

Required documents for registration

As noted above, you can apply for an earthquake insurance policy at any bank branch or at a specialized agency. You need to have the following documents with you:

- Copy of TAPU (Property Title Certificate).

- Information about the area of the site and the property.

- Passport details of all owners registered in TAPU.

- TIN of the owner/owners.

- The full address of the property.

Summary

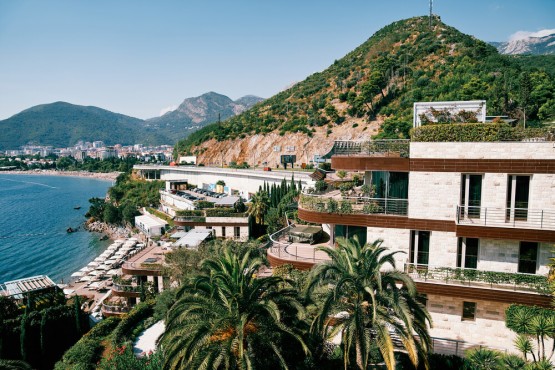

Purchasing real estate in Turkey, you can be sure of the maximum protection of your own investments. Nordic Property offers you to buy an apartment in Alanya, one of the most seismically safe cities in the Republic of Turkey, and enjoy your vacation and living by the sea.

If you have any questions regarding the conditions and execution of the DASK state insurance policy, as well as the acquisition of property in a paradise corner of Turkey, please contact Nordic Property employees!

Read also